Bankruptcy Court Clerk for Sagadahoc County

There is a court clerk for every bankruptcy court. The court clerk is responsible for handling of filed documents for the bankruptcy court. In general, the court clerk’s office is located in the same location as the bankruptcy court. The court clerk is also available to provide legal information about your bankruptcy case, this is only legal informtaion, not legal advice.

Sagadahoc County Bankruptcy case Debtor and debts

The party for filing bankruptcy is referred to as the “Debtor”. While a bankruptcy filing can help the debtor discharge most debts that they owe, it cannot discharge all debts. Debts that can be discharged in bankruptcy include credit card debt and other unsecured debts. Debts secured by a property, such as a mortgage, cannot be discharged. There are other debts that cannot be discharged in a bankruptcy and the debtor would continue to owe these even after the bankruptcy, examples include some tax debt, alimony, and child support. Debts for student loans also cannot be discharged unless it can be proven to be an “undue burden”, which is a very difficult burden to meet.

What are the bankruptcy rules in District of Maine Bankruptcy Court?

All rules and procedures of for bankruptcy are defined in the Federal Rules of Bankruptcy Court and the local rules.

What is bankruptcy?

Bankruptcy is a legal process which Debtors can file for and in which they are able to relieve pressure from burdensome debts. This takes place through a bankruptcy discharge which releases a Debtor from personal liability of certain debts and prevents Creditors from ever taking action against the Debtor to collect those debts.

Sagadahoc County Bankruptcy case Creditor

The creditor in a bankruptcy case is owed or claims to be owed money by the debtor of the case.

Required court appearances?

In general, a Chaptor 7 filer will not usually have to appear in court. They would only have to appear in court if there is an objection that is filed.For Chapter 13 cases, in general, the filer will only have to appear at a plan confirmation hearing.You may be required to attent a 341 meeting, which is required under Section 341 of the United States Bankruptcy Code. This meeting requires the debtor to attend be questioned by creditor(s) about their property and debt.

Attorney requirement

An individual can file a bankruptcy case without an attorney and represente for themselve as “pro se” or “pro per”. This is not very common as bankruptcy cases are very complex, and filers are required to follow all rules and procedures of the court regardless of how they are represented. A partnership, corporation or any other organization are required to have an attorney.

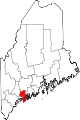

Sagadahoc County Bankruptcy Court

All bankruptcy cases originating in Sagadahoc County are filed and handled by District of Maine, United States Bankruptcy Court. There are 90 federal judicial district courts across the United States. Each district court has a specific bankrupcty court which handles the filing originating in its jurisdicition. See below for specific court information for Sagadahoc County.

Chapter 7 vs. Chapter 13 bankruptcy

Chapter 7 bankruptcy takes all of the debtor’s assets (that are not exempt) and dissolves them and apportions the monies to the debtor’s unsecured creditors. This is the simplest and fastest form of bankruptcy. A 2005 change in bankruptcy law now requires a filer pass a “means test” to be allowed to file for Chapter 7 bankrutpcy. If the filer does not meet the “means test” the case will be converted to Chapter 13 or dismissed.Chapter 13 bankruptcy allows an individual to maintain their posessions and assets, and sets up a payment plan to repay their debt back over a 3-5 year period. A recurring source of income is required to setup a plan to pay back part or all of their debts. Chapter 13 allows one to keep their posessions or assets, while Chapter 7 liquidates all of their non-exempt posessions or assets.

Sagadahoc County requirements for filing in District of Maine Bankruptcy Court

You must reside in Sagadahoc County or have Sagadahoc County be the principle place of your business in order to file District of Maine Bankruptcy Court. District of Maine jurisdiction also includes: Androscoggin County, Aroostook County, Cumberland County, Franklin County, Hancock County, Kennebec County, Knox County, Lincoln County, Oxford County, Penobscot County, Piscataquis County, Sagadahoc County, Somerset County, Waldo County, Washington County, York County

Sagadahoc County Bankruptcy Court

District of Maine only handles bankruptcy cases within it’s jurisdiction. A tort or breach of contract case must be filed in Maine State Court (or District of Maine Court).

What is an automatic stay?

A key feature of a bankruptcy filing is an automatic stay. An automatic stay immediately occurs when bankruptcy is filed. The automatic stay will stop utility shut offs, debt collections, foreclosures, evictions, garnishments, attachments, reposessions and most lawsuits.

Bankruptcy Trustee

A bankruptcy trustee is a court appointed representative of the bankruptcy estate and can exercise certain statuatory powers for the benefit of the unsecured debtors. A trustee can be a private individual or corporation in Chapter 7, 12, and 13 cases, in addition some Chapter 11 cases can also have a bankruptcy trustee. For Chapter 7 cases, the trustee is responsible for liquidating and distributing the debtor’s estate. For Chapter 12 and 13 cases they are in charge of overseeing the debtor’s repayment plan. The trustee is responsible for reviewing the debtor’s bankruptcy petition and schedules. The trustee is also able to bring actions against both the creditor or debtor in a bankruptcy filing in order to recover property of the estate.

What is a discharge?

A bankruptcy discharge removes the obligation and liability from the debtor for certain debts. The debtor can no longer be held responsible to repay the debts that were discharged in a bankruptcy. This is a permanent and the creditor can no longer pursue the debtor for repayment of any kind. It is illegal for the creditor to pursue any form of collection action against the debtor for a discharged debt including written correspondence or phone calls. A discharge removes personal liability, but any liens that were not voided in the bankruptcy remain valid. For Chapter 7 cases, a discharge may take place in as little as 4 months from the filing of the bankruptcy petition. For Chapter 12 and 13 cases, the discharge only takes place AFTER all re-payments have been made to fulfill the payment plan outlined in the bankruptcy case. This is normally in 3-5 years.

Chapter 7 Means Test

When filing for Chapter 7 bankruptcy, if the filers income is more than the state median income, then they must satisfy a “Means Test”. If their income is less than the state median income, they can file for Chapter 7 bankruptcy. The means test takes the the debtor’s aggregate current monthly income over 5 years, net of certain statutorily allowed expenses, is more than (i) $11,725, or (ii) 25% of the debtor’s nonpriority unsecured debt, as long as that amount is at least $7,025.The debtor may rebut a presumption of abuse only by a showing of special circumstances that justify additional expenses or adjustments of current monthly income.Unless the debtor overcomes the presumption of abuse, the case will generally be converted to chapter 13 (with the debtor’s consent) or will be dismissed. 11 U.S.C. § 707(b)(1).

Bankruptcy Rules

The United States Constitution Article I, Section 8 grants Congress permission to pass laws pertaining to bankruptcy. Bankruptcy rules and procedures are written in Title 11 of the United States Code, these are referred to as the Federal Rules of Bankruptcy. Under these rules, the judge in a bankruptcy case has jurisdiction to make all decisions for the manner including the debtor’s eligibility for filing and discharge decisions. Most of the bankruptcy process is administrative. For Chapters 7, 12, and 13 the bankruptcy trustee performs most of these administrative activities.

Credit Counseling Requirement before filing?

Potential individual bankruptcy filers must complete a credit counseling class and receive a certificate prior to actually filing for bankruptcy. This can be done online in about an hour.

Financial informtaion requirements for bankruptcy filing?

The following information will be required in order to file for Bankruptcy:

- Prior 2 years of tax returns

- Documentation of income (paystubs for previous 6 months, previous 2 W-2s)

- Valuation and list of any property holdings that you may have including relevant mortgage information, insurance information, etc.

- Valuation and list of any vehicles you may own including documentation of insurance, registration, and any applicable loans

- Retirement account balances

- Documentation of any alimony or child support payments you owe

- Valid identification (ie. State issued Drivers License)

- Social Security card (or proof of your Social Security Number)

- Complete list of ALL creditors you currently owe money to. This needs to be a complete list including the name of the creditor and amount you owe.

Six different types of bankruptcies

Chapter 7 Bankruptcy

Chapter 7 Bankruptcy (sometimes referred to as Liquidation), involves a trustee ordered by the court taking over the Debtor’s assets, liquidating them to cash, and dispurses the cash to Creditors. There are certain exemptions to the assets that the Debtor is entitled to keep. In general, there are little to no assets that the Debtor has to liquidate, so the Creditors will not receive anything under this type of bankruptcy filing. These are referred to as “no-asset cases”. A Creditor will only receive a distribution if there are assets available to be liquidated, referred to as an “asset case”. In most circumstances, the Debtor is an individual and will receive a discharge that releases them from the liability of the debts. It usually takes a few months from the initial filing to the receiving of the discharge. There is a “means test” that the Debtor must qualify for in order to be able to file for Chapter 7 bankruptcy.

What is a Chapter 13 Bankruptcy Case?

Chapter 13 is designed for a Debtor who has a regular source of income. Chapter 13 is preferred by most Debtors over Chapter 7 because it allows a Debtor to keep a certain asset (usually a house), and allows the Debtor to set up a “plan” to repay Creditors over a period of time (usually three to five years).Chapter 13 is also used by individual Debtors who do not qualify for Chapter 7 under the “means test.”The confirmation hearing is where the court either approves or rejects the Debtor’s repayment plan.In making its decision, the court looks to the requirements for determination under the U.S. Bankruptcy Code.Chapter 13 is different from Chapter 7 because the Debtor usually remains in possession of the property (usually the house), and makes payments to the Creditors for the duration of the payment plan.Also a difference from Chapter 7, is that the Chapter 13 Debtor does not receive a discharge until all the payments required under the plan are made.One other advantage is that the discharge under Chapter 13 is broader than under Chapter 7 (ie. more debts are eliminated).

What is a Chapter 11 Bankruptcy Case?

Chapter 11 is normally used by commercial enterprises that wish to keep operating a business and repay Creditors through a debt repayment plan approved by the bankruptcy court.During the first 120 days, the Debtor has the exclusive right to file a plan of reorganization and provide Creditors with a disclosure statement that provides the Creditors with enough information to evaluate the plan. The bankruptcy court makes the ultimate decision to approve or reject the reorganization plan.Under the plan for reorganization, the Debtor can reduce its debts by discharging some or repaying only a portion of its obligation under the original debt.Under this Chapter, the Debtor undergoes a period of consolidation and leaves with a reduced debt load and reorganized business.

What is a Chapter 12 Bankruptcy Case?

Chapter 12 is written specifically for farmers of fisherman. The procedures under Chapter 12 are very similar to those under Chapter 13. Under Chapter 12, the Debtor agrees to pay a portion of the Debtor’s debts under repayment plan (between three and five years).Like Chapter 13, under Chapter 12, there is also a trustee appointed to to disperse payments to Creditors.Under Chapter 12, a fisherman or farmer is able to continue operating a business while the repayment plan is carried out.

What is a Chapter 9 Bankruptcy Case?

A Chapter 9 bankruptcy allows for a municipality (city, town, county, school district or other public entity), to undergo a reorganization that is very similar to that available to commercial enterprises under Chapter 11. This Chapter is only available to municipalities.

What is a Chapter 15 Bankruptcy Case?

Chapter 15 deals with corporate entities where a Debtor or a Debtor’s property is subject to the laws of the United States and one or more foreign states.

What are the filing fees for a bankruptcy case in Sagadahoc County?

The filing fee varies depending on which Chapter the debtor is filing under.

- Chapter 7 – $306

- Chapter 9 – $1213

- Chapter 11 (non-railroad) – $1213

- Chapter 11 (railroad) – $1046

- Chapter 12 – $246

- Chapter 13 – $281

- Chapter 15 – $1213

Sagadahoc County Bankruptcy Court Location

- Bangor

Address: 537 Congress Street, Portland, ME 04101 202 Harlow Street, Bangor, ME 04401

Phone: Portland Office 207-780-3482 Bangor Office 207-945-0348

Email: webmaster@meb.uscourts.gov

Hours: Portland Hours 8:30 am – 1:00 pm 1:30 pm – 4:30 pm Monday-Friday Bangor Hours 8:30 am – 1:00 pm 1:30 pm – 4:30 pm Monday-Friday

Leave a Reply